Section 179 Tax Deduction

Hard Work Pays Off

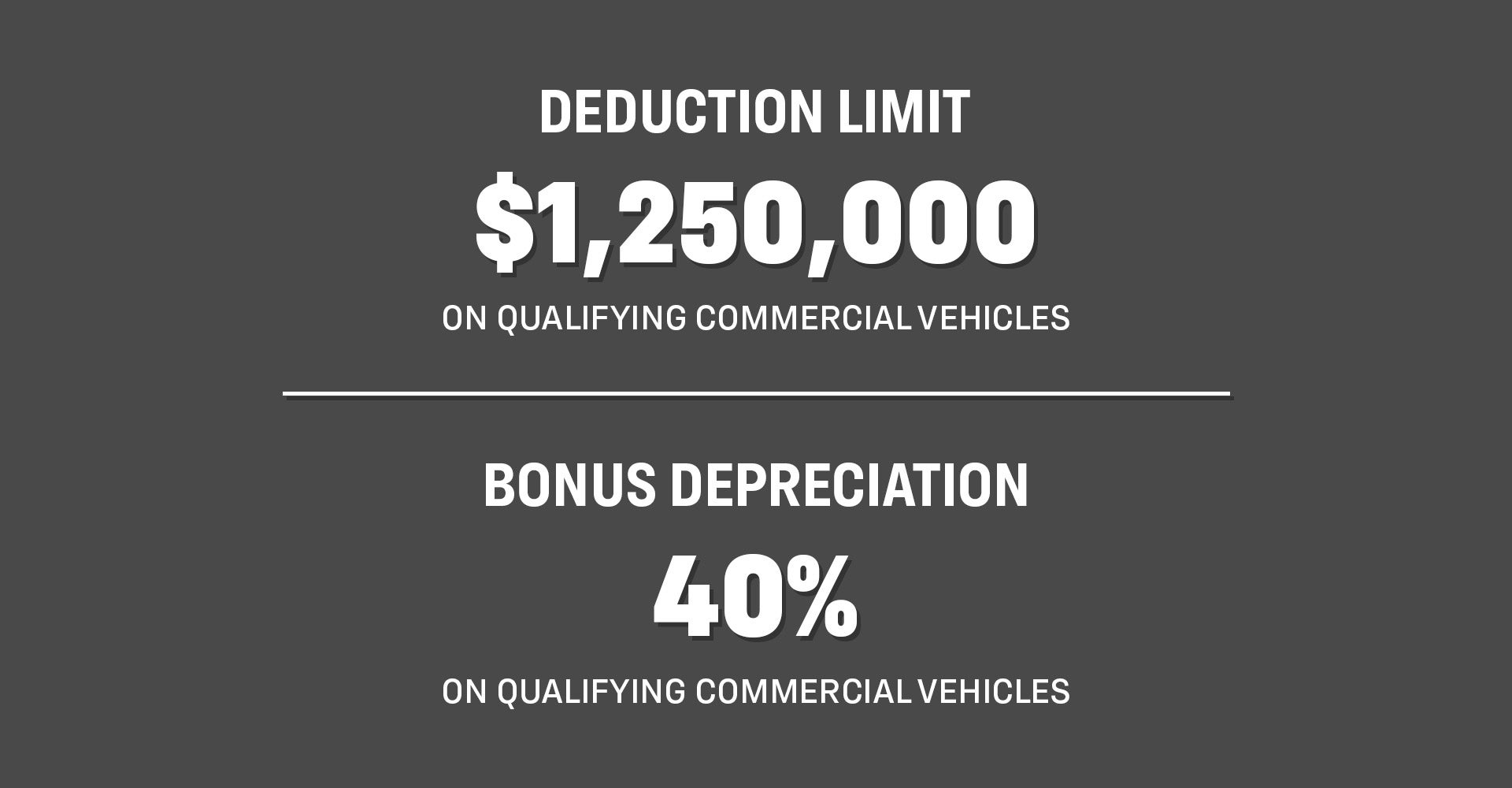

Ensure your business has the tools you need to succeed for years when you purchase a new Chevrolet commercial vehicle in Milford, OH. Mike Castrucci Chevrolet invites fellow qualifying business owners to save big by taking advantage of the Section 179 tax deduction through the Internal Revenue Service (IRS). Stay at the top of your game without going over budget and enjoy a deduction limit of $1,250,000 and a purchase limit of $3,130,000 during a tax year, as long as your new Chevrolet will be used for commercial purposes more than 50% of the time.* If you're ready to make some changes, what are you waiting for? Score Section 179 tax savings when you visit Mike Castrucci Chevrolet to start shopping.

Eligible Chevrolet Models

Find several bestselling Chevrolet models in your reach for eligibility, like the Chevy Silverado 1500, the Chevy Silverado 2500 HD, the Chevy Silverado 3500 HD, the Chevy Suburban, the Chevy Tahoe, the Chevy Express Cargo Van, and more. Enhance convenience and efficiency while on the job and watch your productivity levels skyrocket as you utilize high-demand commercial-friendly features like superior towing power, performance, ample passenger and cargo space, and state-of-the-art technology.

Grab Your Boots

Simplify a hard day's work with the Section 179 tax deduction when you upgrade your commercial fleet at Mike Castrucci Chevrolet, your home for bestselling and affordable Chevrolet models for sale in Milford, OH.

Shop Now| Monday | 9:00AM - 6:00PM |

| Tuesday | 9:00AM - 6:00PM |

| Wednesday | 9:00AM - 6:00PM |

| Thursday | 9:00AM - 6:00PM |

| Friday | 9:00AM - 6:00PM |

| Saturday | 10:00AM - 5:00PM |

| Sunday | 11:00AM - 5:00PM |

| Monday | 7:30AM - 6:00PM |

| Tuesday | 7:30AM - 6:00PM |

| Wednesday | 7:30AM - 6:00PM |

| Thursday | 7:30AM - 6:00PM |

| Friday | 7:30AM - 6:00PM |

| Saturday | 8:00AM - 1:00PM |

| Sunday | Closed |

| Monday | 7:30AM - 6:00PM |

| Tuesday | 7:30AM - 6:00PM |

| Wednesday | 7:30AM - 6:00PM |

| Thursday | 7:30AM - 6:00PM |

| Friday | 7:30AM - 6:00PM |

| Saturday | 8:00AM - 1:00PM |

| Sunday | Closed |